Drive brand sales at retail stores and online. Measure your merchandising and optimize your circular performance. Grow your brand share and volume.

The More The Merrier

2% of shoppers drive 80% of sales. Catalina helps retailers and brands drive efficient volume, generate incremental sales, and eliminate waste and subsidy, in five steps:

- Target high-potential, frequent brand and category buyers.

- Deliver engaging, omni-channel messaging.

- Sell at the threshold goal in a single shopping trip.

- Reward shoppers with cash-back on their next trip.

- Measure shopper behavior and redemption to gain valuable insights.

Hit Your Target

Shoppers ignore 93% of items sold in-store. Catalina helps retailers and brands find the highest-value buyers and escalate their buy rate (and returns) over time, in five steps:

- Target your highest-potential brand buyers.

- Deliver engaging, omni-channel messaging.

- Reward shoppers with escalating incentives in real-time.

- Boost buy rate with a digital media overlay to reach shoppers between trips.

- Measure shopper behavior and redemption to gain valuable insights.

Walk And Chew Gum

26% of ads are wasted on the wrong strategies. Maximize the impact of every marketing dollar by reducing waste and over-subsidization, and expanding reach without expanding your budget. Catalina helps drive efficiency with these tools:

- Post-Purchase Suppression: Block previously converted shoppers from future media to reduce waste.

- Tiered Offer Values: Use historical purchase pricing to tailor offers and convert shoppers more efficiently.

Make Your Business Personal

Extend the reach of your retail paper circular into digital channels, and deliver the most relevant content and personalized weekly deals to shoppers based on their past purchases. So you can stay top-of-mind with your best shoppers throughout the week, before and after their shopping trips.

Ad to Cart

Catalina offers a comprehensive set of solutions for retailers, brands, and agencies to understand e-commerce behavior, measure campaign impact, and target shoppers with media driving to online purchase.

You can also target shoppers from outside Catalina’s network with media to accelerate purchase at a variety of major retailers, including Walmart, Amazon, Target and pet e-commerce retailers.

See our Sales Drivers solutions in action.

After a period of cooling, overall U.S. grocery inflation re-accelerated modestly in Q3 2025, ticking up from 2% to 3% YOY, according to Catalina's Shopping Basket Index. This uptick was primarily driven by a massive inflationary surge in Coffee which was offset by price drops in key categories, including soft drinks, paper products, deodorants, and cereal.

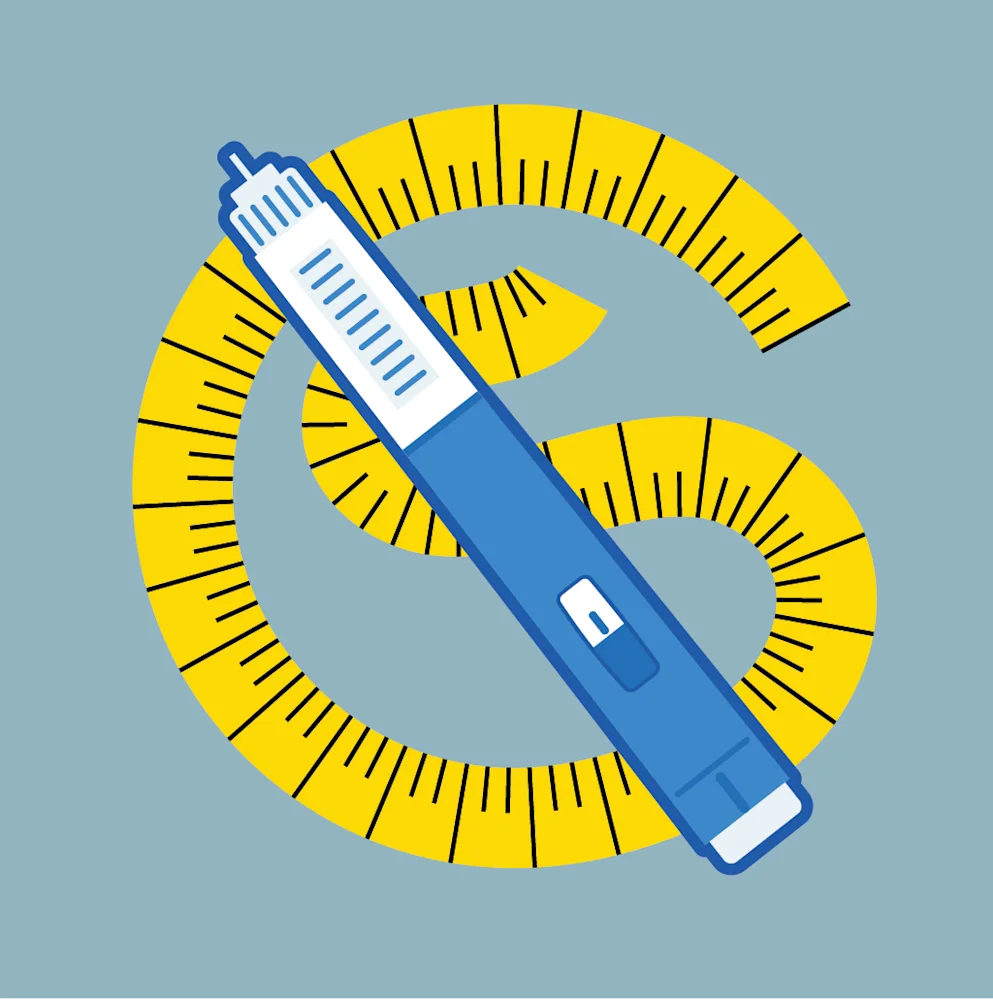

The rise of GLP-1 medications is fundamentally changing consumer dietary habits, creating new challenges and opportunities for retailers and CPG brands. To unlock growth, marketers can leverage Catalina’s proprietary GLP-1 Shopper Profile to gain insights on how to adapt to this new consumer group and engage them with personalized, omnichannel messaging.

UK shoppers are showing a stronger preference for printed coupons over digital ones, with Gen Z leading the shift away from digital overload. Emotional connection and personalization are driving loyalty, making physical offers a powerful tool for engagement. Read more here.

2025 demands a united data front. Catalina’s comprehensive guide to data analytics and insights shows CPG brands and retailers how to collaborate to reach their most loyal customers through contextual targeting, responsive marketing, AI-based bidding, and more.

Catalina’s Q1 2025 Shopping Basket Index, which tracks the aggregate average price changes of 10 common grocery product categories, shows grocery price inflation in the U.S. continued to cool in the first quarter of 2025, with a few tariff-related exceptions.

Catalina’s Shopping Basket Index reveals grocery price inflation cooled in the first quarter of 2025, dropping to 2% overall compared to the previous year. While most categories show moderating inflation and some frozen food prices have declined, staples such as deodorants, coffee, and soft drinks are experiencing upward pricing pressure. Data shows that potential tariff-related cost increases on imported goods may quicken price hikes in specific categories.