Future-Proof Your CPG Marketing: The 2025 Guide to Leveraging CPG Data Analytics and Insights

The data dynamic between Consumer Packaged Goods (CPG) marketers and retailers continues to evolve.

Today, neither brands nor retailers have a complete picture of consumer behavior at scale across all platforms and media channels. Even with Google's U-turn on phasing out third-party cookies this year, the industry is still moving towards a privacy-first approach.

Without a federal privacy law in the US, several states are enacting their own comprehensive approaches, which creates a patchwork of regulations for marketers to navigate. The rapid adoption of AI by marketers is prompting even more scrutiny about privacy.

In this uncertain environment, CPG marketers are actively adopting new strategies to get a holistic view across all platforms and channels. They use data to get a more comprehensive look at a shopper’s journey — which now involves 20-500 touchpoints, up from 10-200 touchpoints only a few years ago1 — but their data looks primarily at past behavior and, without complementary context, can offer limited guidance for successfully driving the next sale. Retailers also have an incomplete view of the shopper ecosystem, measuring only what happens in their stores or on their e-commerce sites.

CPG brands have turned to Retail Media Networks (RMNs) to fill in the gaps, making their relationship with retailers more intertwined. The growth of RMNs in the US — expected to top $62B by this year2 — reinforces the value of the data retailers gather through loyalty cards. But marketers say managing multiple RMNs is expensive, cumbersome, and only provides a limited picture. Marketers must still combine RMN data with their own first-party data and privacy-compliant third-party data from other channels for a complete picture.

![]()

Finding the best data path forward requires a collaborative approach between brands and retailers. Data is at the core of this conversation, but not all data is created equal.

Consider this guide a conversation starter. This data-driven playbook will allow you to future proof your 2025-26 marketing plans by explaining:

- the components of a best-in-class data stack

- how to effectively reach consumers in the ever-changing media landscape

- why contextual advertising is making a comeback

- how artificial intelligence (AI)-based bidding improves effectiveness

- practical applications through real-world examples

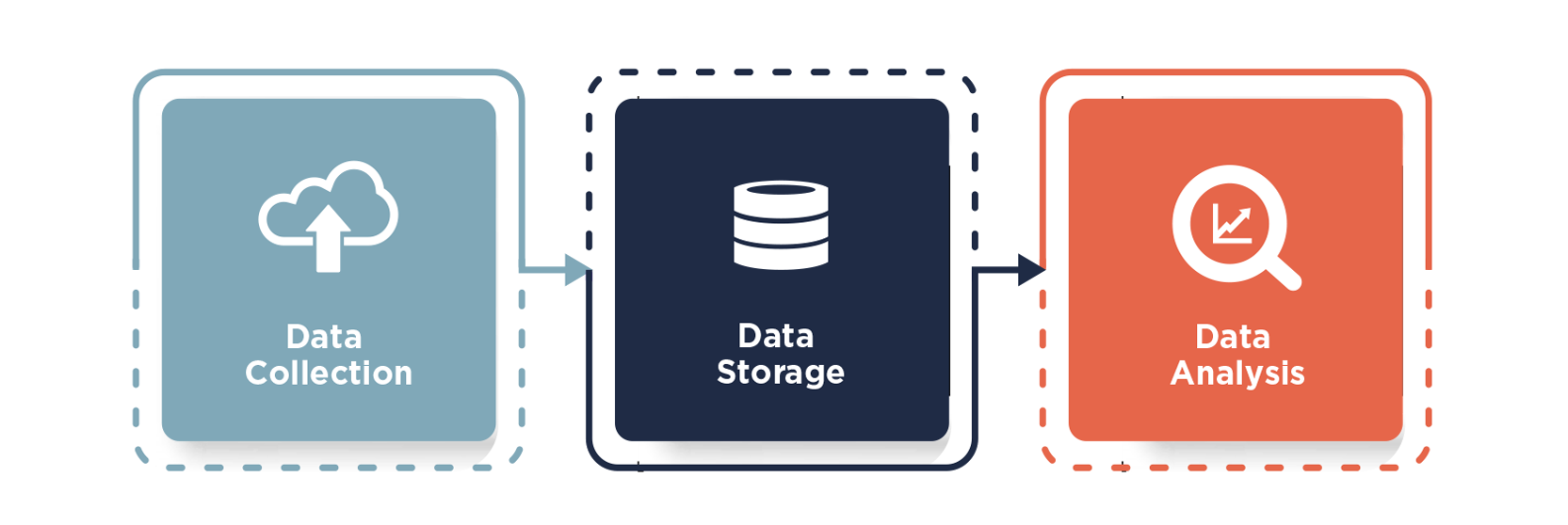

What is the Best Data Stack Investment Strategy?

A best-in-class data stack should consist of these core components:

- Data collection: Gathering first and third-party data from sources such as website analytics, customer relationship management (CRM) systems, social media platforms, and point-of-sale (POS) systems.

- Data storage: Storing collected data in a secure and scalable way that allows for easy access and retrieval.

- Data analysis: Analyzing the collected data to efficiently gain actionable insights into consumer behavior, preferences, and trends.

In late 2024, marketers reported using only one-third of their martech stack’s capability, down from 42% in 2022 and 58% in 20203. Utilization continues to drop even as martech spending grows. The survey cites costs, lack of training, and data privacy concerns.

Yet, 96% of marketers say data stacks help them achieve strategic objectives, with 61% saying they are generally satisfied and looking for improvement areas. Those surveyed said they plan to enhance their AI capabilities, focusing primarily on personalization of content (46%), customer segmentation (45%) and predictive analytics and insights (38%).

Martech technology spending4 is projected to reach $558B this year and grow at a CAGR of 20% between 2025 and 2034. Investing in a best-in-class data stack — either by building it or partnering with a data analytics specialist — gives you a competitive advantage. It will improve customer understanding, allow you to optimize marketing campaigns, and deliver a more personalized customer experience.

What are the Most Important Considerations for Your CPG Data?

Today’s marketing data is not only broader in scope but also deeper and more granular. Its sheer volume and variety pose significant challenges, especially as shoppers increasingly value privacy.

Gone are the days when you could count on phone numbers and demographics as the basis of your plan. And while website clicks and social media activity can give some insight into preferences, privacy rules based on intent or interest make it incomplete.

A strong data stack can collectively bring visibility to what a brand or retailer’s customers do, why they do it, and what they may do in the future. It can also categorize unknown shoppers and clarify how to change their behavior.

Contextual targeting, which uses first-, second- and third-party data, allows brands and retailers to reach target audiences by matching ads to relevant websites and apps. It can identify and tap into specific topics and communities based on keywords, themes, and website categories. With the deprecation of cookies to track individual shoppers, it offers the best way to reach the right customer with the right message on the right channel at the right time.

First-party data helps you better understand consumer behavior because you can see exactly what they buy, what they watch, or where they shop. It comes directly from customers through website interactions, loyal shopper cards, email signups, and surveys, and can include tracking purchases at the UPC level. You can also acquire first-party data through trusted partnerships with a marketer or retailer.

Eighty-two percent of marketers say that they are investing more in first-party data than they were a year ago.5 It’s considered more accurate, reliable, and relevant, and gives you greater control over how it’s used. But with fewer shoppers opting in to share their data, it’s harder to get a complete picture of your target audiences.

Marketers and retailers need more than first-party data — they also need a toolbox and partners who can help to enhance it.

Third-party data is collected by data analytics partners who look at demographics, purchase history, and online behavior. The majority (58%)6 of marketers say they continue to rely on third-party data because it's useful for reaching new customers and targeting specific audiences that expand their customer base.

Enriched first-party data is a blend of first- and third- party data that’s designed to make it more comprehensive, accurate, and actionable. It involves matching first-party data points, such as email addresses and phone numbers, with third-party data sets to obtain additional information about a target audience. It can also include leveraging lifestyle and behavioral data or machine learning to identify patterns and insights.

Industry reports indicate that investment in first-party data and its enrichment is intensifying, fueled by AI. Identity Graphs are critical at this step. They are core to creating relevancy, cohesiveness, and loyalty. With them, you can deterministically talk to the same shopper inside the store, on-the-go and at home.

For example, to target media across mobile and in-app platforms, many retailers use digital circulars that are designed to engage shoppers with tailored recommendations for sales items.

By applying first- and third-party data to an omni-channel world you can develop a media ecosystem that creates continuous conversations with your shoppers. There’s no need to wait until the next time they shop to communicate relevant value to them.

![]()

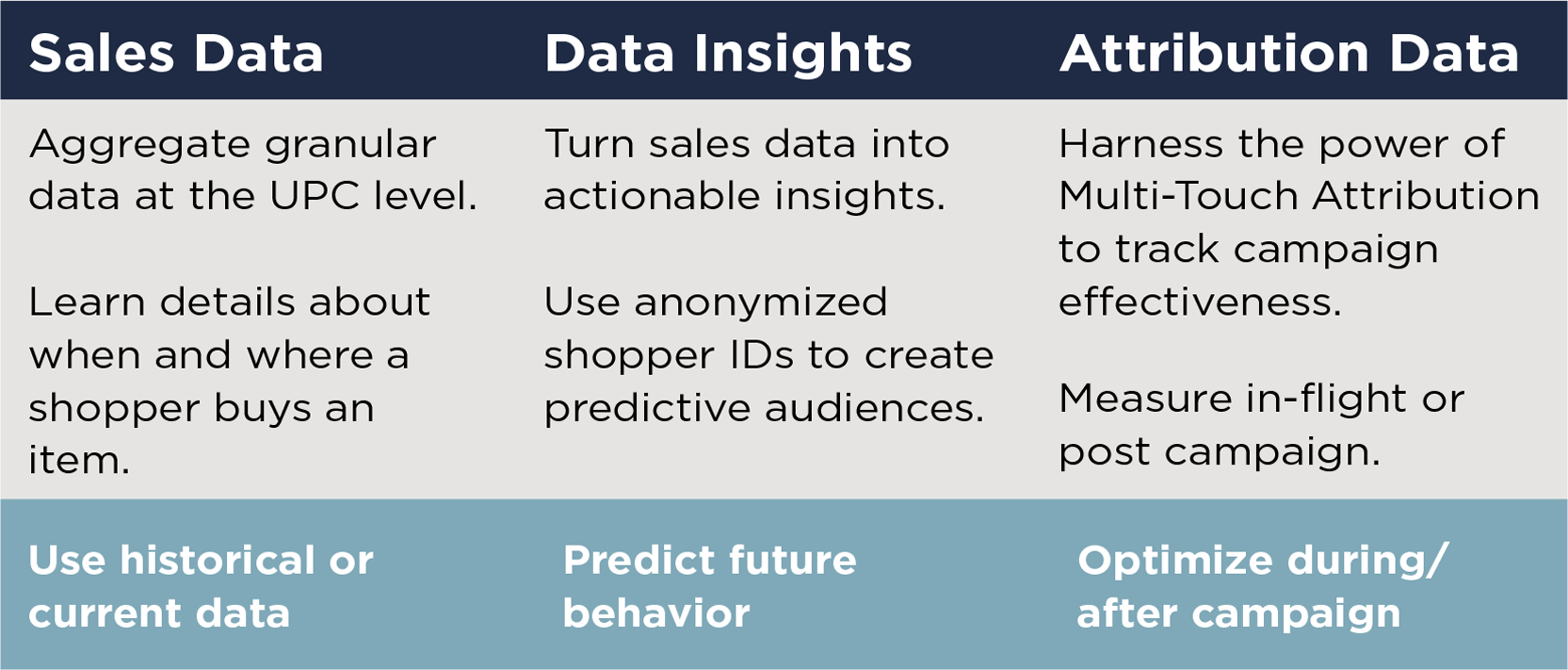

Which KPIs should Retailers and CPG Brands Monitor and Analyze?

Your KPIs can include everything from purchase conversion rates to customer retention and ultimately guide you as you develop future marketing plans. To fine-tune your media investment strategy, use a combination of objective-based, aggregated, and transparent measurement tools:

Objective-based measurement tracks and evaluates marketing performance aligned to predetermined business goals. It measures progress, identifies areas for improvement, and justifies marketing investment.

Aggregated measurement focuses on incrementality. Dig deeper to uncover whether sales came from existing buyers who purchased more product with served-up coupons or from shoppers who aren’t the intended target.

Transparent measurement is closed-loop measurement. It shows what a customer does online and offline before, during, and after a campaign. This granular data — at the UPC level – will show how sales for each SKU grew and which promotions were most effective - during a specific period.

What Approach Should I Take For Channel Measurement?

Take a fresh look at how your media mix impacts your personalization and performance strategies. The most innovative brands and retailers will take advantage of more sophisticated ways to execute the right combination of creative messaging, channels, and timing.

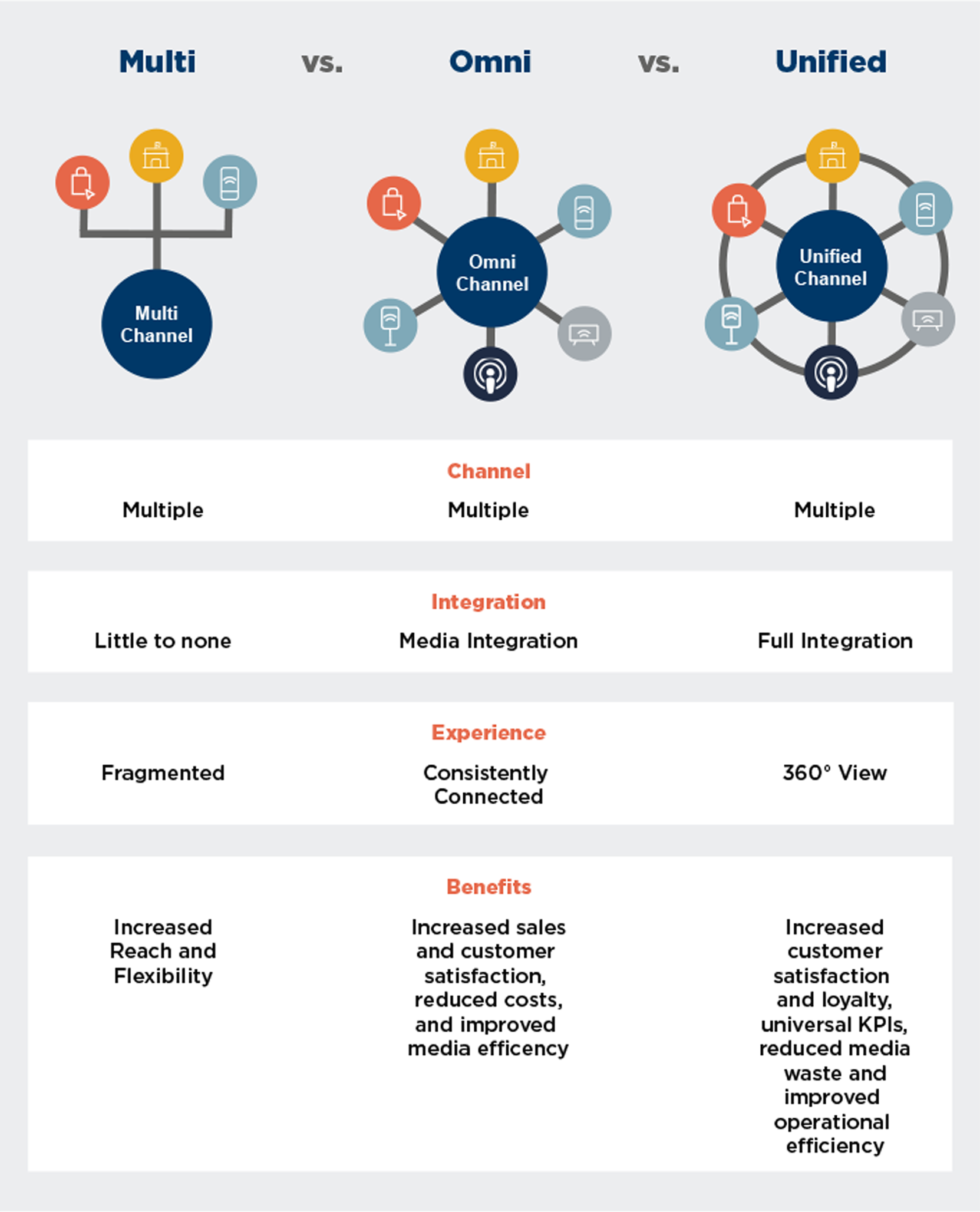

Multi-channel marketing focuses on the product while omni-channel is a consumer-centric approach. Marketers are shifting from multi-channel solutions where data is siloed by channel to omni-channel solutions that are seamlessly connected across channels and enable them to clarify how channels influence one another.

Multichannel vs. Omnichannel vs. Unified-channel Measurement

There is a revolving door of buzz words in our industry, such as “unified media” or “unified commerce”. The chart below outlines the key differences between measurement approaches, focusing on how well they integrate across channels.

Multichannel offers advantages like wider reach and tailored campaigns across multiple channels. But each channel is managed and tracked in silos, so valuable insights and the overall customer journey remain fragmented, hindering a comprehensive understanding of your efforts.

In contrast, omni-channel connects all your channels seamlessly, allowing you to better understand how they influence one another. This holistic approach empowers you to track and optimize campaigns for improved sales and enhanced customer satisfaction. Omni-channel marketing also open doors to executing responsive media and cross-channel analysis so your marketing strategy becomes more cohesive and effective.

Now, the industry is looking at how to execute a unified solution that connects all aspects of your business, from mobile apps to in-store check-out design. Think of unified commerce as a unifying force that simultaneously boosts performance, reduces costs, and streamlines operational efficiency across your entire business model. This holistic solution creates a smoother and more efficient experience for both your customers and your business operations.

The growth of Artificial Intelligence (AI)-based bidding will tame the fire hose of opportunities to target audiences across channels. It streamlines the decision process of when and how much to bid on a specific opportunity and addresses both known and unknown shoppers.

For example, if you’re looking to reach salty snack lovers, AI-based bidding allows you to bid higher on sports media and lower on organic food websites by time of day or geography. It will combine media consumption data from loyalty card shoppers with contextual targeting of similar consumers across channels.

Research shows those who execute strong omni-channel engagement see a 10% YoY increase in annual revenue, while those with weaker strategies report a 3% boost.7 Eventually, the industry is expected to build unified solutions where every aspect of the marketplace is connected, from your mobile app to your store design.

Wherever you’re operating along this continuum, it’s important to create a sophisticated channel matrix to reach shoppers wherever they are exactly when they’re ready to buy.

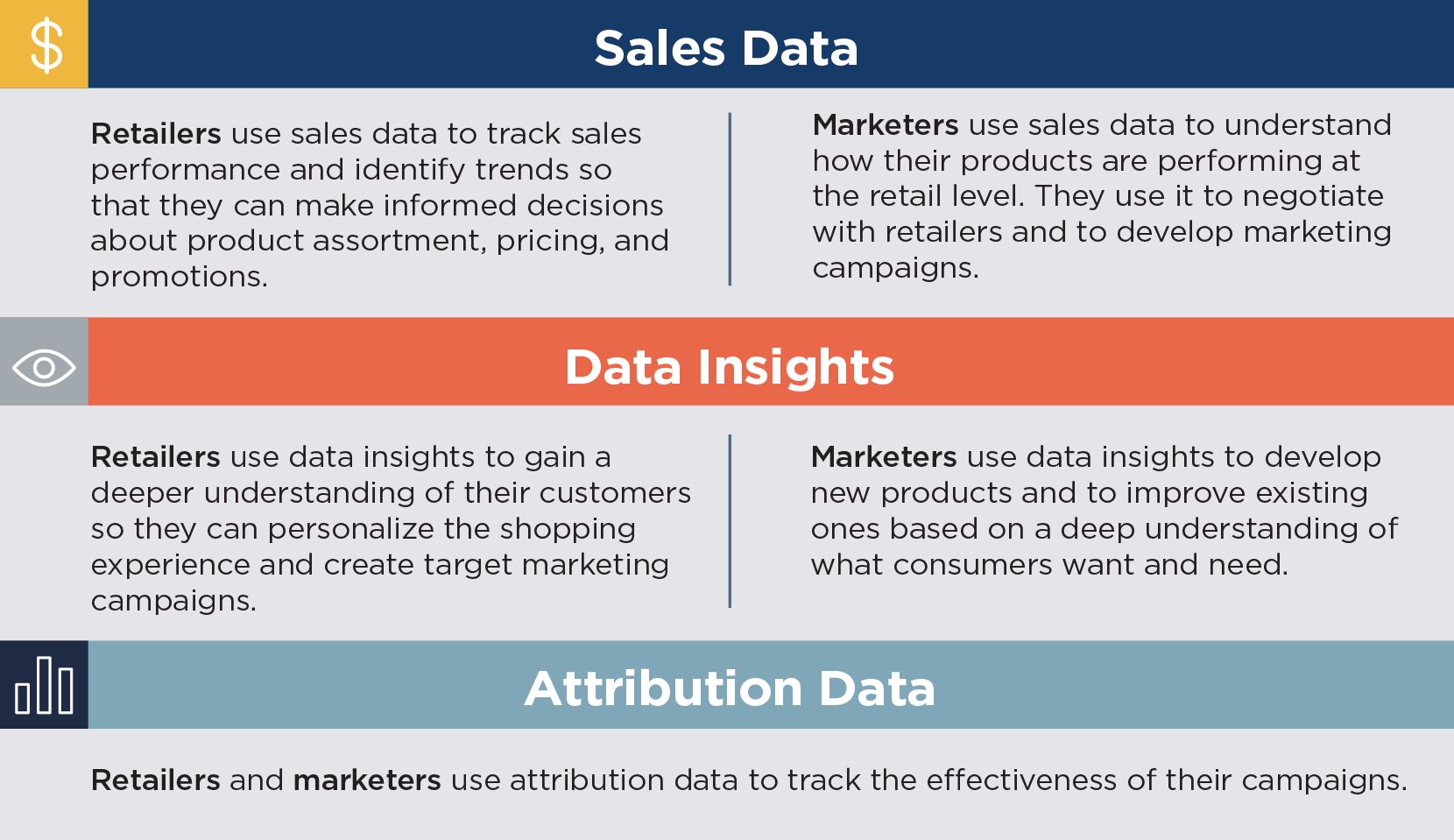

How Data Can Improve Retailer and CPG Brand Performance

Retailers and CPG brands can combine forces to reach their most valuable shoppers. They can aggregate purchase data from shopper loyalty cards or surveys and enhance it with insights about consumer behavior outside of the store.

Retailers can use best-in-class data to see the complete path to purchase—understanding not only what’s happening at their store, but also how and when shoppers engage outside their ecosystem. They can identify actionable insights and monitor performance in-flight, giving them an opportunity to adjust pricing, creative messaging, channel mix, and even product placement in-store.

CPG brands can use best-in-class data to get a clearer picture of what consumers value and how to reach them with relevant messaging. They can use product attributes or competitive brand data to better focus a campaign offering. They can look at purchase behavior to measure the effectiveness of each channel in an omni-channel campaign.

By better understanding purchase behavior, brands can also improve retail distribution and abate out-of-stock issues while retailers can adjust shelf-space and a brand’s product offerings down to the UPC-level based on regional preferences.

CPG marketers and retailers can also use data to stretch their budgets with responsive marketing techniques, which consider consumers’ buying behaviors to dynamically and intelligently serve them the most relevant message during their journey. Also, responsive marketing techniques — like audience and cross-channel suppression — ensure you are not serving media in channels that underperform or to targets that have recently purchased your product.

For example, Caulipower used purchase-based targeting and sequential marketing to recruit new customers and gain back share in the competitive frozen pizza category. The brand was looking for the most efficient way to drive awareness, educate consumers, and incentivize trial among its most valuable targets.

Caulipower tapped into real-time insights to target lapsed and competitive buyers with a connected TV and promotional campaign. High value offers were served only to those who saw its TV ad three times but had not purchased their product. The campaign attracted 74K new buyers and earned a $2.80 ROAS.

Key takeaways: Take a Test-and-learn Approach

In 2025, expect CPG brands and retailers to seek out best-in-class partners in data collection, storage, analysis, and insights who can objectively measure activation at a granular level. When doing so, take a test-and-learn approach, keeping in mind these strategies:

- Set benchmarks upfront. Clearly define the objective of a campaign. Is it to build awareness? Persuade category users to try your brand? Increase purchase frequency of loyal customers? Set measurable KPIs so that brand teams and RMN account managers are accountable through the process and can optimize results in real time.

- Identify actionable insights. Mine campaign data to zero in on what’s most likely to motivate customers to purchase a brand or category. Use data analytics to translate shopper behaviors into the “why behind the buy.”

- Fine tune your audiences. Combine retailer first-party data with deterministic purchase behavior from partners who can measure lifestyle affinities, media behaviors, and all-outlet receipt scans. Limit wasted media dollars by targeting at the household level both digitally savvy customers and those who prefer in-store coupons.

- Take an omni- or unified activation approach. Explore new channels as they emerge and readily adapt to reach shoppers in different ways. Look for partners with flexible models that can adapt to optimize every channel in a multi-touch campaign and provide closed-loop measurement.

- Optimize the media mix in-flight. Be ready and able to quickly adjust your media mix to maximize performance through retargeting, suppression, and sequential marketing techniques. Personalize your messaging and media mix in real-time across platforms.

Why Catalina is a Premier Data Partner for Retailers and Brands

Catalina can help you efficiently respond to your shoppers based on lifestyle and category insights. You can see real-time behavioral and transaction data on anonymized individual shoppers.

This data can reveal the granular differences between gluten-free and organic food buyers or uncover the differences between brand loyalists and switchers. By better understanding media consumption habits, you can identify what channel will most likely convert to a sale.

Catalina offers CPG brands a clear picture of what, where, and why shoppers buy. We provide real-time omnichannel activation at every point across the purchase funnel to seamlessly engage shoppers both inside and outside the store. Our Omnichannel Managed Media Services portfolio includes full-funnel marketing solutions that craft highly targeted custom audiences; deliver precisely personalized messages across In-store, CTV, Out of Home, and Digital media channels; optimize campaigns inflight and provide closed-loop measurement.

Catalina helps retailers maximize their marketing dollars by providing advanced data and analytics insights most relevant to their objectives so that they can achieve incremental sales and growth in key categories and shopper segments.

For all our partners, we are committed to using purchase-based insights in an accountable way, always respecting an individual’s privacy, while measuring and optimizing a campaign to deliver stronger results.

Let’s connect to discuss how we can help your business.

Learn more about our success stories here1 Food Industry Association (FMI) Grocery Shopper Trends (2023)

2 eMarketer

3 Ascend2, The Future of the Martech Stack, 2024

4 Grand View Research, Marketing Technology Market Size, Industry Report 2030

5 Invoca, Data-driven Marketing Trends for 2025

6 Supermetrics, The 2025 Marketing Data Report

7 Digital Commerce 360, 2025