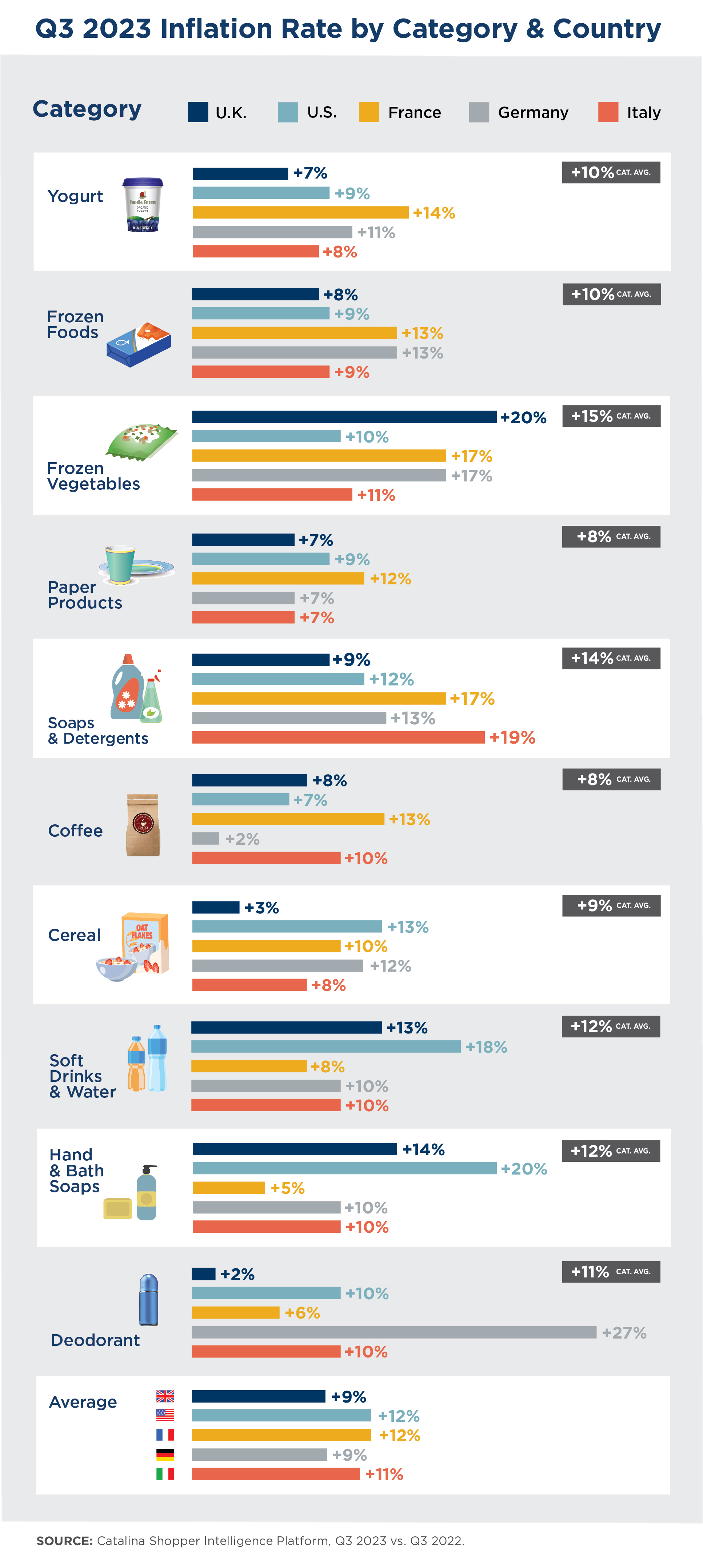

Catalina Shopping Basket Index Tracks Q3 Price Hikes in U.S. and Europe

The impact of inflation on common food and personal care items is easing overall, although prices are falling inconsistently across categories and countries. Tapping into its rich, real-time Shopper Intelligence Platform, Catalina looked at the aggregate price increase of 10 common product categories in the U.S., U.K., Italy, France, and Germany in Q3 of 2023 compared to the same period in 2022.

“Whether you’re shopping in Paris or Pittsburgh, buying groceries continues to cost more than it did a year ago,’ said Wesley Bean, US Chief Revenue Officer. “But price drops vary considerably by category, often impacted by the costs of raw goods, an inconsistent supply chain and the moderation of promotional activity in the marketplace this year as retailers and brands look to effectively manage margins across their businesses.”

Inflation Slows Across U.S. and Europe

In Q3 2023 inflation rates swung from 3% for cereal in the U.K. to 27% for deodorant in Germany, according to Catalina’s Shopping Basket Index. Frozen Vegetables cost 15% more than they did a year ago in the surveyed countries

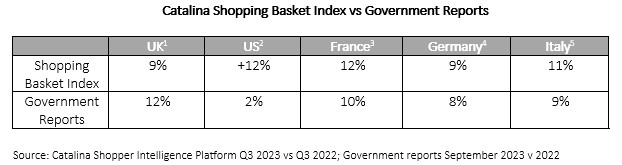

U.S. Posts 10% Gap Between Shopping Basket Index and Consumer Price Index

Inflation rates in the U.S. and Europe mirror findings from Catalina’s Shopping Basket Index—with differences ranging from 1% in Germany to 3% in the U.K. But in the U.S., Catalina’s data shows grocery prices for the Shopping Basket Index categories average 10% more than the Consumer Price Index’s reported average.

U.K. Grocery Inflation Rate Falls Below 10%

In the U.K., prices for seven of the 10 Catalina Shopping Basket Index product categories fell below a 10% rate of inflation in Q3 2023 compared to a year ago. Only Frozen Vegetables (+20%), Soft Drinks & Water (+13%), and Hand & Bath Soaps (+14%) posted higher than the UK’s Office for National Statistics (ONS) report of a 12% annual inflation rate for September. ONS noted that this is the first time monthly food and non-alcoholic prices have fallen since September 2021.

Grocery Product Inflation Softens in France, Germany, Italy

Italy reported 9% inflation for food at home -- its softest rate since January 2022, according to the country’s National Institute of Statistics. Except for Soaps & Detergents, which posted a 19% price hike over the previous year, in Italy Catalina’s Shopping Basket Index categories averaged 10% inflation, including Coffee, Soft Drinks & Water, Hand & Bath Soaps, and Deodorant products.

Germany’s overall inflation rate fell to 5%, its lowest level since the outbreak of the war in Ukraine in February 2022, according to the country’s Federal Statistical Office. The cost of food at home trended higher at 8% YOY for September. However, Coffee prices rose only 2% during this period, according to the Catalina Shopping Basket Index. But these lower inflation rates were offset by a 27% price increase for deodorants from a year ago. Frozen Vegetables (+17%), Frozen Foods and Soaps & Detergents (both +13%), and Cereal (+12%) hovered higher than the country’s overall inflation rate for food at home.

In France, INSEE data shows food prices continue to rise, but at a slower rate from 11% in August to 10% in September. According to Reuters, high food prices have spurred consumers to cut back on purchases as the French government tries to persuade retailers and producers to reduce prices. Personal care products such as Deodorant (+6%), Hand & Bath Soaps (+5%) and Soft Drinks & Water (+8%) posted price increases lower than the country’s overall inflation rate while others hovered well above the average (Frozen Vegetables and Soaps & Detergents +17%), according to Catalina’ Shopping Basket Index.

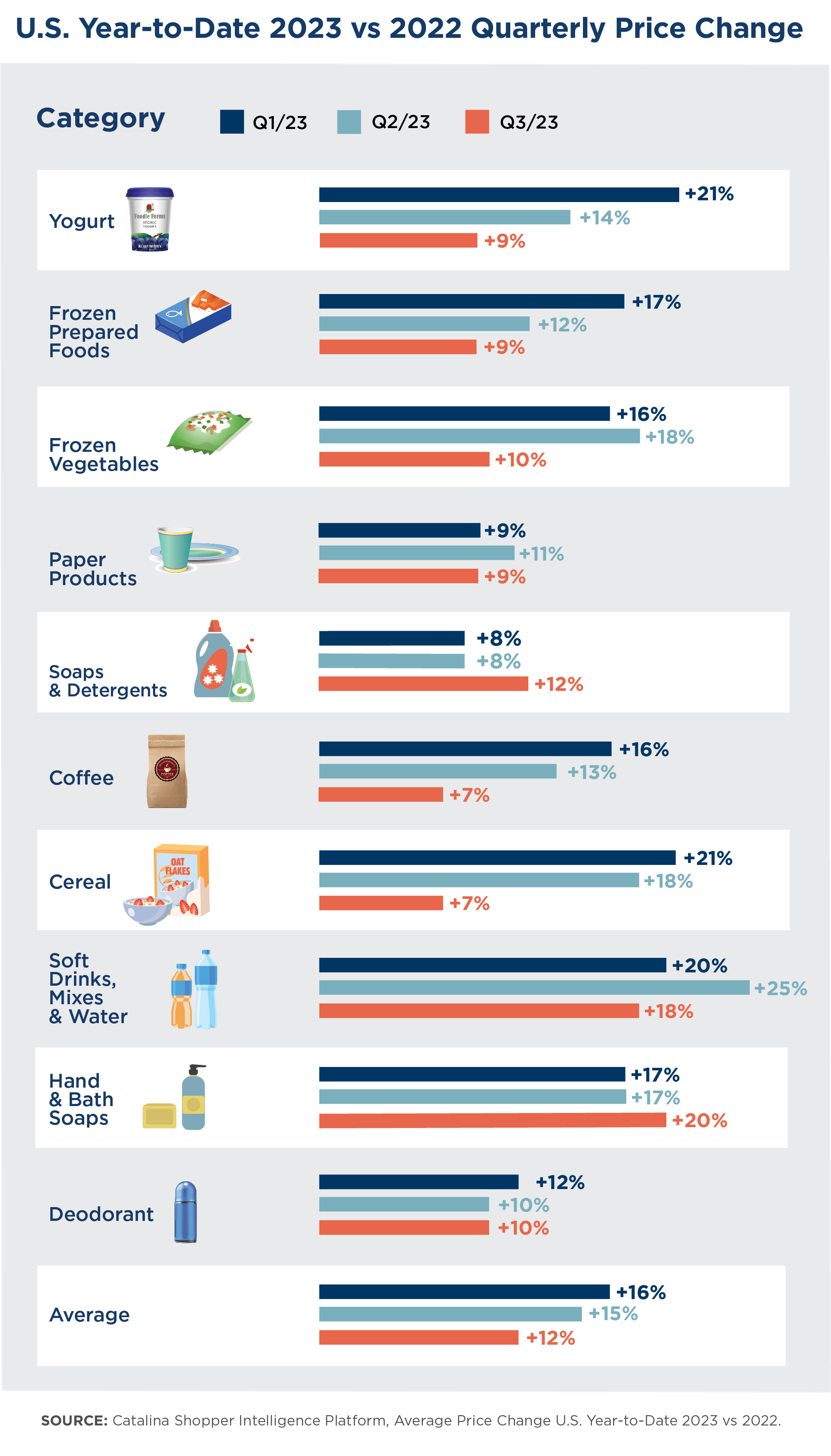

Inflation’s Impact on U.S. Consumers Differs by Grocery Category

The impact of inflation fluctuates significantly by category in the U.S., according to Catalina’s Shopping Basket Index. Prices of Yogurt, Frozen Foods and Paper Product rose 9% compared to Q3 2022, while the cost of Frozen Vegetables and Deodorant increased 10% over the same period. In contrast, the price of Hand & Bath Soaps rose 20%.

Year-to-date SBI data uncovers promising price trends, however. Only Hand & Bath Soaps (+3%) and Soaps & Detergents (+4%) cost more than they did in Q2 2023. Frozen Prepared Foods prices dropped modestly by 3% in Q3 but are down 47% since Q1. Frozen Vegetable prices dropped 8% from Q2, with the share of private brands rising 6%.

About Catalina

Catalina is a leader in shopper intelligence and highly targeted in-store, TV and digital media that personalizes the shopper journey. Powered by the world's richest real-time shopper database, Catalina helps retailers, CPG brands and agencies optimize every stage of media planning, execution and measurement to deliver $6.1 billion in consumer value annually. Catalina has no higher priority than ensuring the privacy and security of the data entrusted to the company and maintaining consumer trust. Catalina has operations in the United States, Costa Rica, and Europe. To learn more, visit www.catalina.com.

1 UK Office of National Statistics

2 US Consumer Price Index

3 INSEE, France

4 Federal Statistical Office, Germany

5 National Institute of Statistics, Italy